View All

Bozeman Real Estate Market

Development

Bozeman Business

Bozeman Neighborhoods

Get Outside

Moving to Bozeman

Retiring in Bozeman

Just for Fun

The Selling Side

The Buying Side

Bozeman Nonprofits

Affordable Housing

Community Events

Living in Bozeman

Belgrade Real Estate

Livingston Real Estate

Manhattan Real Estate

Three Forks Montana Real Estate

Big Sky Real Estate

Moving to Montana

Home Ownership

Living in Montana

Bozeman Real Estate Group

What Really Happened in Bozeman's Real Estate Market in 2025 (Data, Trends & Takeaways)

On Jan 20, 2026

As 2025 wrapped up, we couldn’t wait to dig into the data.

Everyone is talking about how the market has slowed, and in many ways, that’s true. We see it every day: homes taking longer to sell, price reductions becoming more common, and an overall sense that buyer activity isn’t what it was a few years ago.

But when we really scrubbed the numbers, we were hard-pressed to find any jaw-dropping statistics, and trust us, we tried!

We went to seminars, talked to other agents, and stared at spreadsheets. The story turned out to be pretty straightforward: things have cooled off from the boom years, but mostly the market is just stable now. Boring, we know!

Here are our five biggest takeaways from what happened with the Bozeman real estate market in 2025.

1. Buyers Haven’t Disappeared

Closed sales: 1,625 (2025)

There’s no denying that the market changed once mortgage rates increased and the pandemic boom faded. There were 1,625 closed sales in Gallatin County in 2025. Compare that to the peak in 2021 when we hit 2,798 sales, and sure, it looks like a drop.

But here's the thing: for the last three years, we've been hovering right around this number. Same with the median price, it's been basically flat.

The market didn't fall apart. It just stopped being insane.

2. Sellers Had to Get More Realistic on Pricing

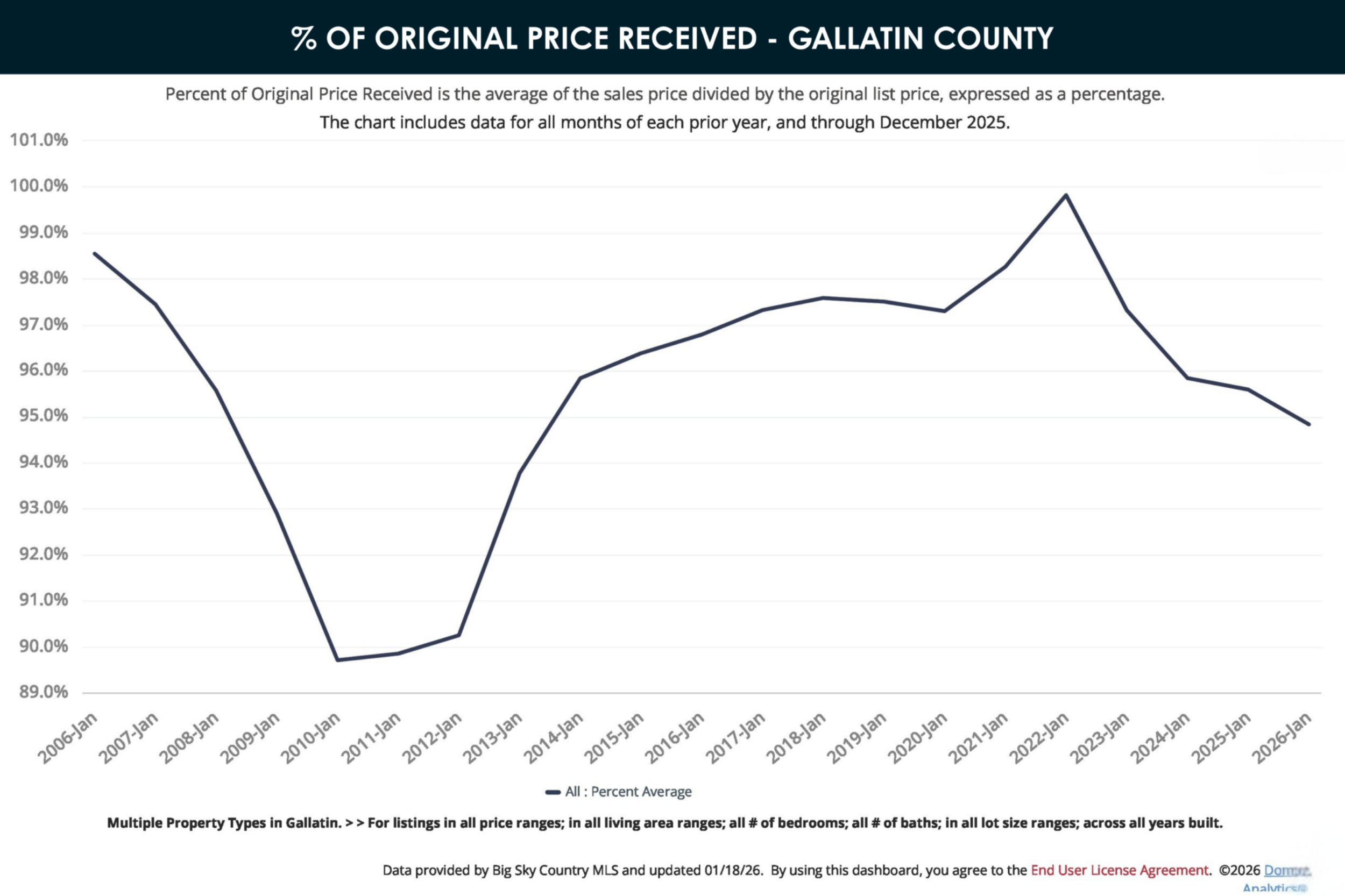

Average percentage of original price received: 94.8% (2025)

In 2025, the average home sold for 94.8% of the asking price. That actually sounds pretty good until you realize the last time sellers had to accept that kind of discount was back in 2012–2013.

The 'list it high and watch people fight over it' days are over. Now there's negotiation. Price cuts. Actual market forces at work again.

Homes priced right from the start still do fine. The ones that overshoot and then chase the market down? Those struggle.

3. Houses Take Longer to Sell

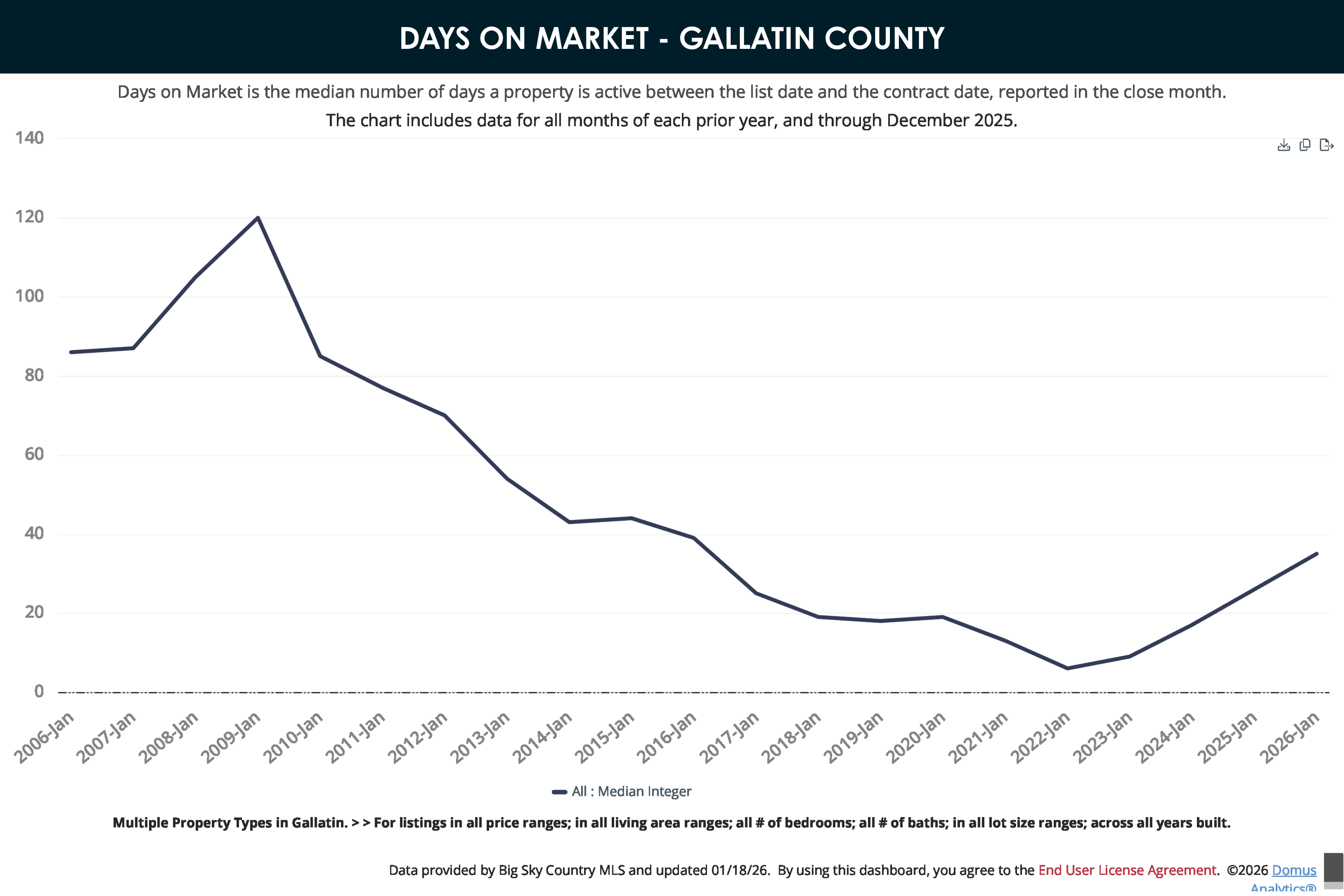

Median days on market: 35 days (2025)

The median days on market hit 35 in 2025. Ten years ago, that was normal. During the pandemic boom, the median was six days.

It's not a crisis—during the Great Recession we saw 120-day averages—but it's a real shift. Buyers aren't in panic mode anymore. They're taking their time.

4. More Listings Don't Always = More Homes Sold

New listings: 2,715 (2025)

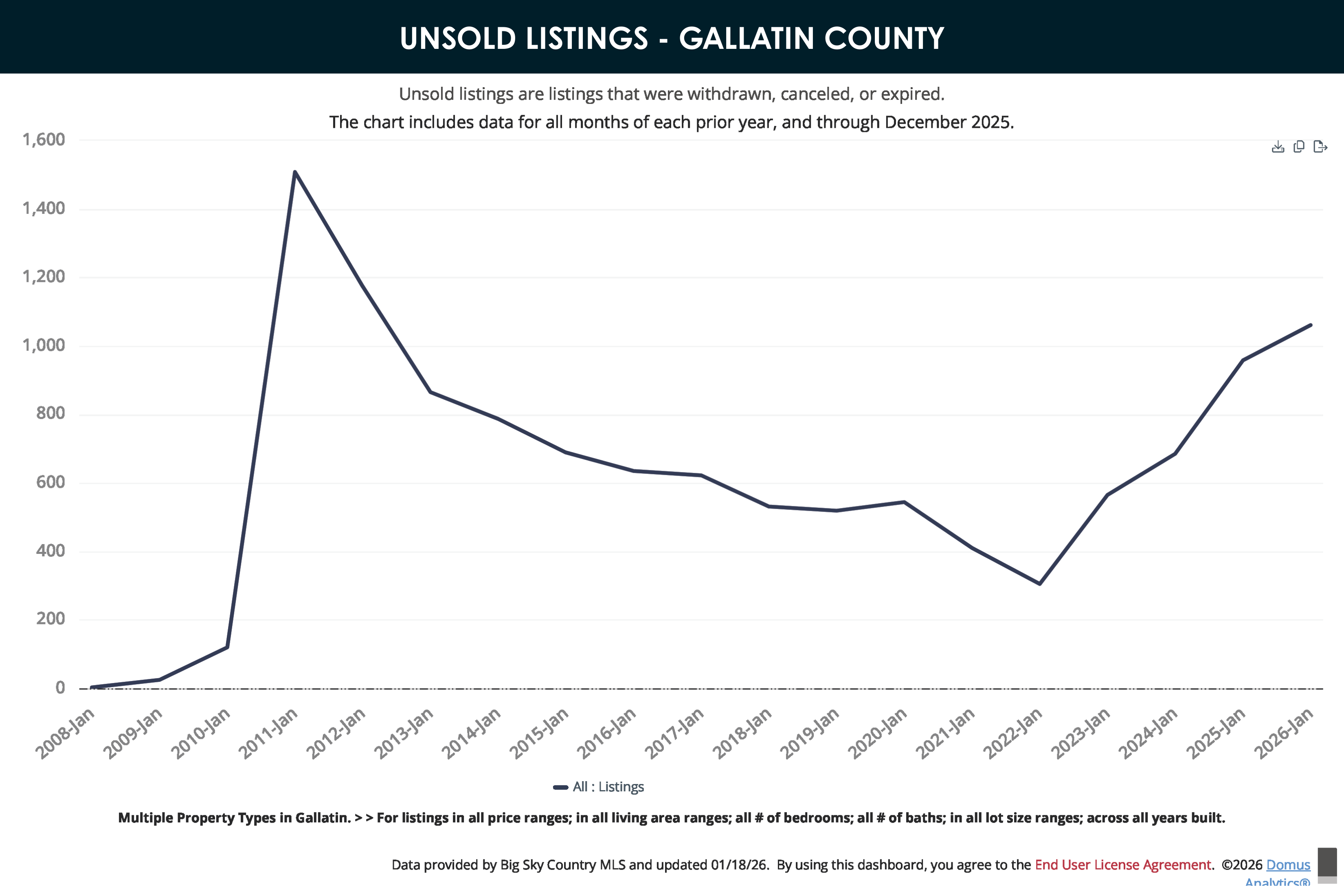

Unsold listings: 1,061 (2025)

After mortgage rates rose, we saw a noticeable dip in new listings. In 2023, just 2,275 homes came on the market in Gallatin County. By 2025, that number rebounded to 2,715.

But more inventory didn’t translate directly into more sales.

In fact, unsold listings jumped to 1,061—10% higher than the previous year and 247% higher than in 2021. We haven’t seen unsold inventory reach this level since 2011–2012.

When over a thousand listings don’t make it across the finish line, it usually points to a few consistent issues:

- Overpricing

- Condition or layout challenges

- A disconnect between seller expectations and what today’s buyers will pay at today’s rates

For buyers, this means more opportunities to find price reductions and motivated sellers.

For sellers, this is where guidance really matters. The goal isn’t just to list, it’s to strategize.

5. Prices Stayed Elevated, but Are Stabilizing

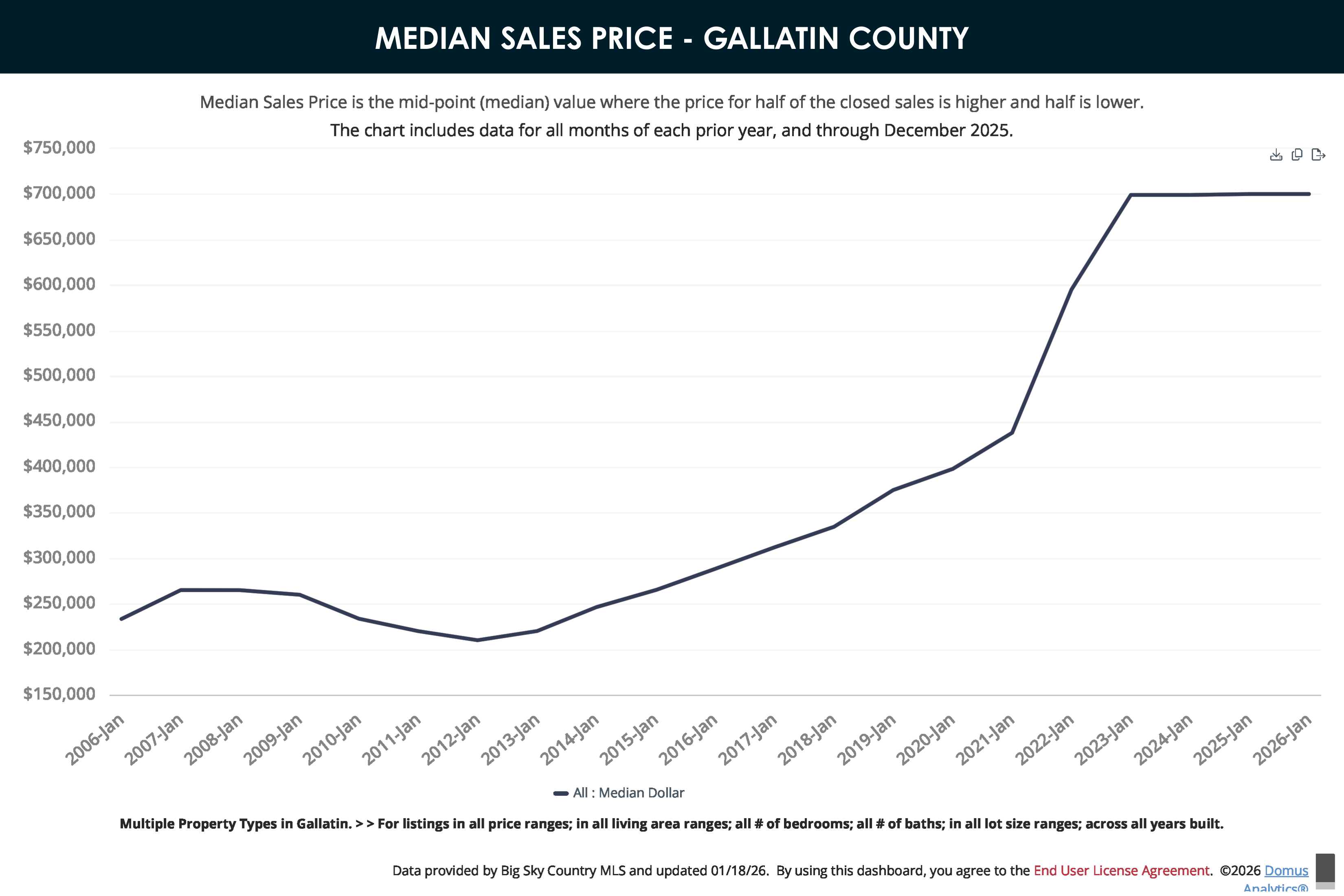

Median sales price: $700,000 (2025)

Given how different the market felt this year, we expected to see prices fall. But that’s not what the data showed.

Prices have basically plateaued for three years now. They're not going up, but they're not falling either. Just... holding steady.

What This Means Heading Into 2026

After years of extremes, we’re finally in a market that behaves like a normal market again. That may not generate dramatic headlines, but it does create healthier conditions for everyone involved.

If you’re buying, prices are still steep, but there’s room to negotiate now. If you're selling, you can absolutely still get your home sold, but it won't happen on autopilot. Pricing matters. Condition matters. Timing matters.

To see what's on the market now, click here.

➡️ Want more information like this?

FAQ's About the Bozeman Real Estate Market

It depends on your situation, but the market is definitely more favorable to buyers than it was a few years ago. With homes sitting on the market for an average of 35 days and sellers accepting 94.8% of asking price, there's actually room to negotiate now. You're not competing against 15 other offers like you would have been in 2021. That said, prices are still high, but there are more homes on the market in lower price points than we've seen in years.

Prices have been flat for three years. They're not climbing, but they're not falling either. We're not seeing the kind of crash some people are waiting for. If you're trying to time the market perfectly, you might be waiting a long time. The better question is: can you afford to buy a home that meets your needs at current prices and rates?

Just a reminder, you do not need 20% down to purchase a home.

We had 1,061 listings that were withdrawn, canceled, or expired in 2025. Usually it comes down to pricing—sellers listing too high and refusing to adjust. Sometimes it's condition issues or properties that just don't appeal to today's buyers. The market isn't as forgiving as it was during the pandemic. If a home is priced right and shows well, it still sells.

Yes, but 'quickly' means something different now. The median time on market is 35 days, not six. If you price it right from the start, your home can still move. But if you overprice and hope for the best, you'll likely end up chasing the market down with price cuts, and that rarely ends well.https://bozemanrealestate.group/real-estate/price-reductions

On average, homes are selling for 94.8% of the asking price. That means most sellers are coming down about 5% from their list price. Of course, this varies. Well-priced homes in great condition might get closer to asking, while overpriced or problematic properties could see bigger reductions or no sale at all.

Click here to see all price reductions.

If rates drop significantly, you'd likely see more buyers enter the market, which could push prices up and speed up sales. But predicting rate movements is a guessing game. If you're waiting for rates to hit 3% again, you might be waiting for a very long time, or it might never happen. Buy when it makes sense for your life, not based on rate speculation.

We're not seeing any signs of that. Prices have stabilized, not collapsed. Sales have been consistent for three years. The market cooled off from the insanity of 2020-2021, but it didn't break. We're in a normal market now, which means fundamentals matter again: location, condition, and pricing.